What Is A Captive?

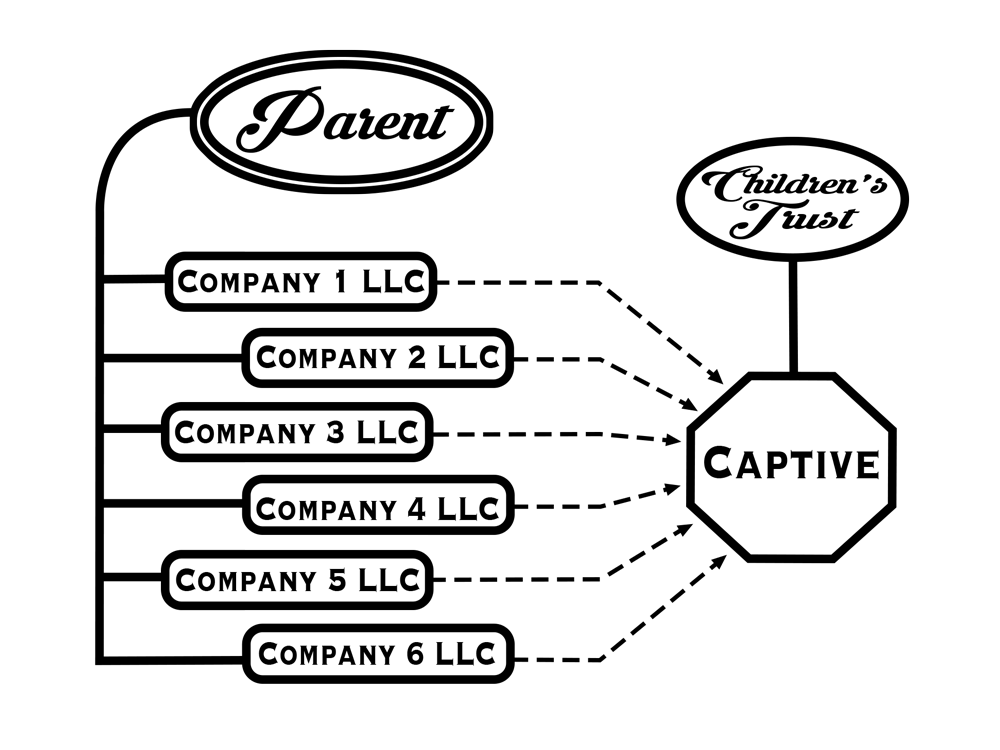

Insuring the risks of your many operating businesses without paying those premiums outside your family corporation, that's the point of your newly formed Captive Insurance Company.

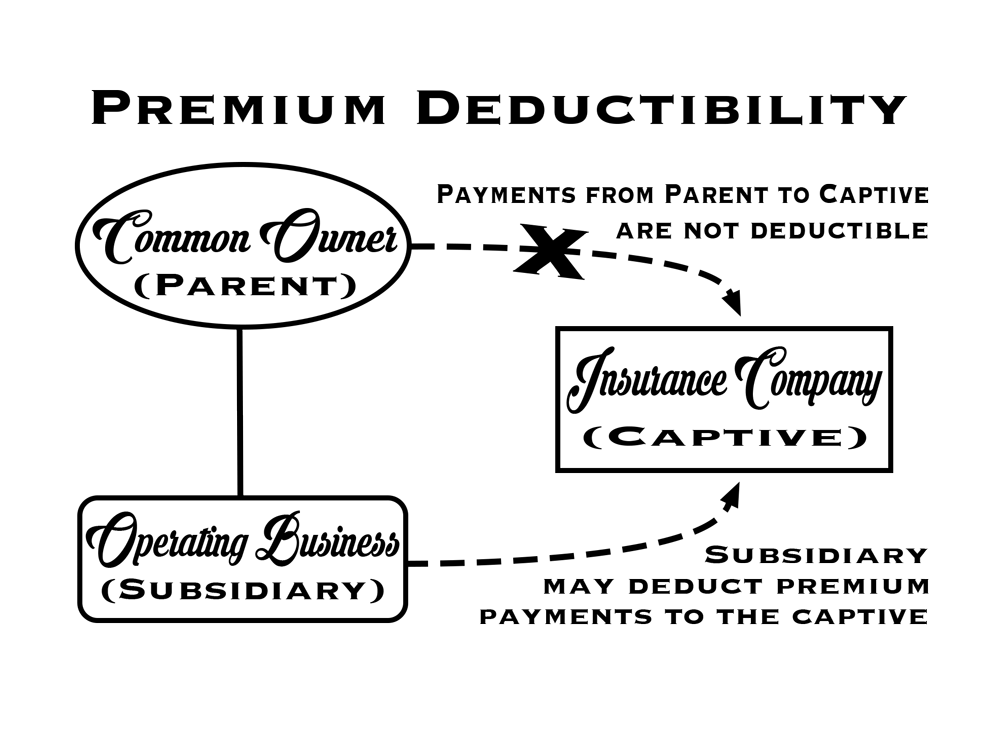

Created as a tax shelter and risk management asset, a "captive" is an independently owned and operated insurance company, with reserves, surplus, policies, set premiums, and claims processes. The Captive insures the risks of subsidiary companies, and may also be owned by another entity like a descendant's trust fund.

In this way, the Captive serves as a tax-free method of wealth transfer, while at the same time housing your insurance premium dollars in the framework of your overall business structures.

What Can It Do For My Money?

Owned by you, a captive insurance company creates a risk management asset that insures the risks of your subsidiaries, while also providing you the opportunity to grow your asset portfolio and potentially reduce your tax exposure.

Captive insurance provides the flexibility of self insurance while still retaining the risk management of traditional insurance programs, and even better they offer the opportunity to insure against events not typically available for insurance on the open market.

The captive can also be owned by another entity, like a descendant's trust fund, serving as a tax-free method of wealth retention and transfer.

Advantages

Owning a Captive Insurance Company has numerous advantages over buying insurance from a traditional company, including:

Improved claims control

More consistent premiums

Access to reinsurance markets

Investment income earned on premiums

Reduced insurance administrative costs

Liability & wealth transfer